Traditionally, only Bermudian citizens, their families and expats could purchase property in Bermuda. However, this doesn’t mean non-Bermudians can’t purchase properties here.

In 2021, the Bermuda government changed the policy on how people from overseas can buy property in Bermuda.

The new Economic Investment Certificate & the Residential Certificate Program were launched on 1 March 2021. They change the way overseas buyers can buy leasehold condominiums in Bermuda. For more information, please click here.

IIf you aren’t Bermudian and want to purchase a slice of paradise, you must know Bermuda’s real estate laws and legislation. Here’s everything you need to know when it comes to purchasing property in Bermuda:

- The Documents and Visas Required

- Bermuda Immigration and Protection Act 1956: Requirements and Exemptions

- Land and Property Taxes

The Documents and Visas Required

If you’re a citizen of the USA, UK or Canada, you don’t require any kind of visa to enter Bermuda. You’re all set to experience the beautiful island once you have a valid passport and return tickets. Visitors are always welcome in Bermuda and can stay for up to six months and buy real estate.

However, it’s essential to realize that although international buyers can purchase real estate in Bermuda, it doesn’t make you eligible for Bermudian citizenship or permanent residency.

For overseas buyers to buy real estate in the country, they must obtain a License to Acquire real estate from the Bermuda Government Ministry. The process can take three to nine months, so give yourself enough time for approval. The license fee depends on the type of property the buyer wishes to purchase.

The license fees are set at:

- 6% of the purchase price of a condo.

- 8% of the purchase price of a house.

- If you’re a non-Bermudian long-term local resident, the fees will be 4%.

At certain vacation condo properties — such as Bermudiana Beach Resort, Tapestry Collection by Hilton — owing to specific Government legislation, this license fee is waived, creating significant savings for overseas buyers.

Bermuda is very popular, so it’s no surprise that property prices for this idyllic location are high. The island is exclusive and houses are incredibly sought after, so consider purchasing a vacation condo. You’ll still have your piece of Bermuda but at a much lower price with the ability to rent your property out when you aren’t there.

You’ll also have access to facilities, like swimming pools or gyms, for example, that are maintained for you by a management company. Perfect for vacationers or retirees who just want to relax and enjoy their time.

Bermuda Immigration and Protection Act 1956: Requirements and Exemptions

Various amendments to the Bermuda Immigration and Protection Act 1956 have allowed overseas buyers to buy real estate in Bermuda.

Here’s a summary of the requirements, exemptions and exceptions:

- To be eligible for purchase by an overseas buyer, the property’s Annual Rental Value (ARV) must be more than a designated amount ($25,800 for a condominium and $126,000 for a house).

- Once an overseas buyer finds their ideal home and enters into a Sale and Purchase Agreement, they must submit their application to purchase along with a consideration fee. A local attorney will facilitate this.

- Once a Sale and Purchase Agreement has been signed, a deposit of 10% of the property’s purchase price will be paid.

- The Immigration Department can permit overseas owners to rent their property. Permission rarely extends to periods of more than a year and there will be an additional tax of 7.25% for short-term rentals. However, this is waived in some new resort/residential developments, such as Bermudiana Beach Resort.

- Overseas buyers aren’t allowed to buy property with the primary intent of earning rental income. But, recent changes to the Bermuda Immigration and Protection Amendment (No 2) Act 2010 permit this if the property is tourist accommodation or hotel residence.

There are questions you need to ask yourself and your realtor before putting pen to paper. So, if you think you’ll miss something, don’t worry; we have you covered. We’ve compiled a checklist to help you streamline your purchase process. This checklist covers everything you need to know to make an informed decision about buying a condo in Bermuda. Download it below today for free.

Land and Property Taxes

Despite Bermuda’s reputation as a tax haven, which is widely misunderstood, you still need to consider things like the cost of living and indirect tax fees. There are also taxes land on the land and property that you purchase. However, paying land tax is simple and you can even pay online. These rates are assessed on the property’s Annual Rental Value. At the time of writing, they are set as follows for residential property:

|

Annual Rental Value |

Tax Rate |

|

$0 to $11,000 |

0.8% |

|

$11,001 to $22,000 |

1.8% |

|

$22,001 to $33,000 |

3.5% |

|

$33,001 to $44,000 |

6.5% |

|

$44,001 to $90,000 |

12% |

|

$90,001 to $120,000 |

25% |

|

$120,001 and over |

47% |

These rates can fluctuate and change, so stay updated on the Government of Bermuda website.

Now you know some of Bermuda's real estate laws, it’s time to learn more about what this luxury island offers.

Everything You Need to Know About Bermuda: Economy, Accommodation, Lifestyle and More

When purchasing a property in Bermuda, you might be curious about what the island has to offer. From its infamous pink-sand beaches to its laid-back lifestyle — it’s arguably one of the most desirable destinations to be in.

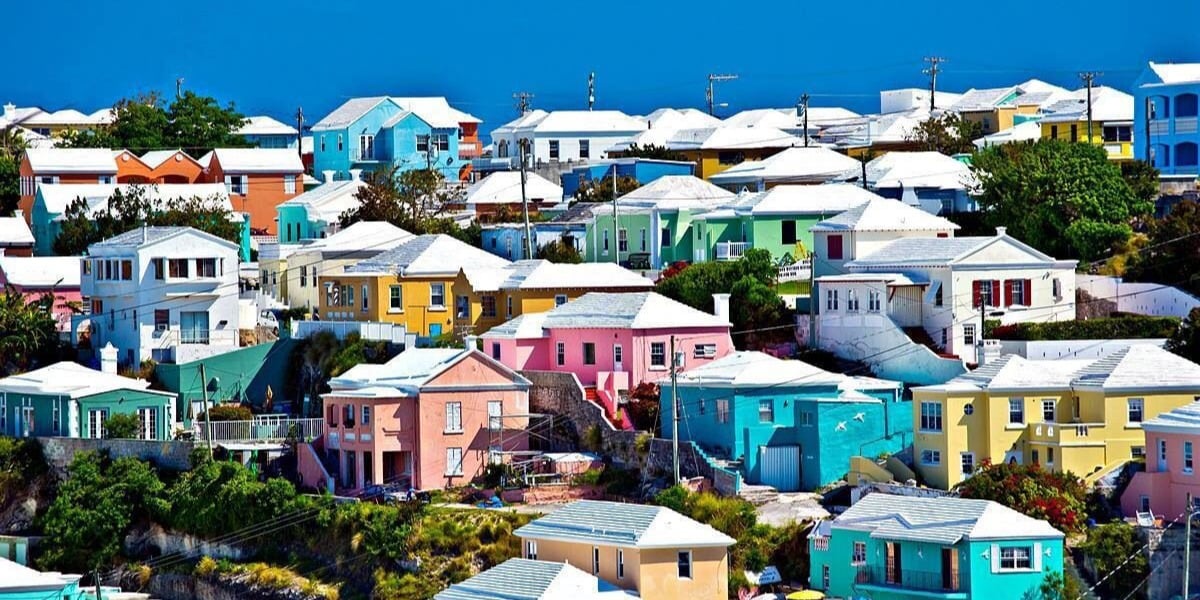

Bermuda is a haven of natural beauty. With its stunning landscapes and a wide variety of activities, Bermuda is a destination like no other. You’re never more than a mile away from the ocean, and the pastel-hued houses of Bermuda create a stunning backdrop all year round.

Bermuda also caters to a range of travel needs. This sub-tropical paradise has something for everyone, from couples retreats to family getaways. Embark on a scenic horseback ride across the island, immerse yourself in a crystal-clear underwater world or enjoy the hidden gems of the Bermudian locals.

We’ve created an ultimate one-stop resource, ‘Lifestyle in Bermuda’, to give you all the information you need to enjoy Bermuda to its fullest. In this guide, you’ll learn about all the beauty of Bermuda. Click below to learn more about this island paradise and how you can fully immerse yourself in this tranquil sanctuary.