The Bermudiana

Beach Resort blog

Read the latest Bermuda news, travel advice and updates from the resort.

Bermuda Beach Spotlight: Jobson's Cove

3 minute readJobson's Cove is a picturesque and serene stretch of coastline on the stunning island of Bermuda. It's situated on the...

Read more

10 Bermuda Historical Sites to Visit

7 minute readGlistening in the pristine waters of the Atlantic Ocean, Bermuda isn’t just a paradise for beach lovers and adventure...

Read more

5 Delicious Restaurants in Warwick, Bermuda

5 minute readBermuda is well-known worldwide for the impeccable assortment of food it offers its visitors — a blend of British,...

Read more

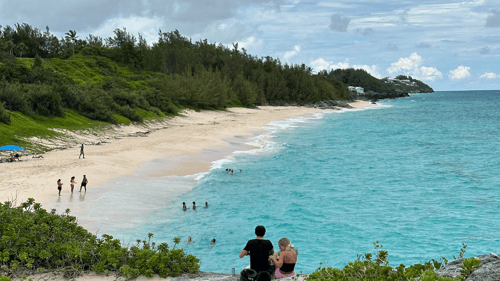

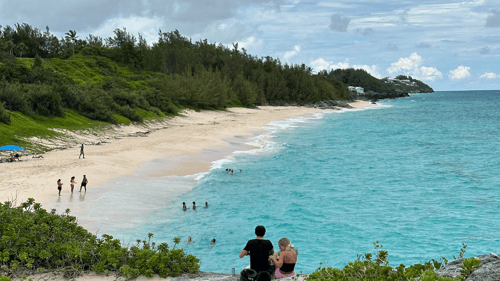

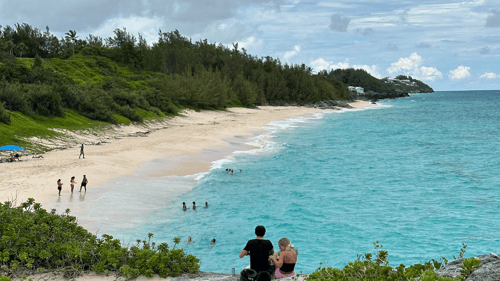

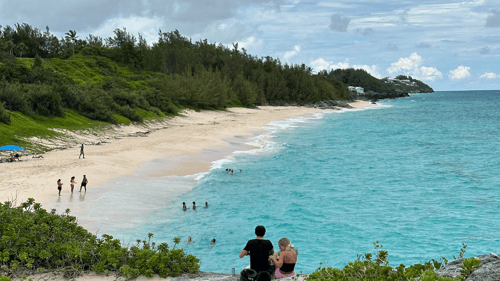

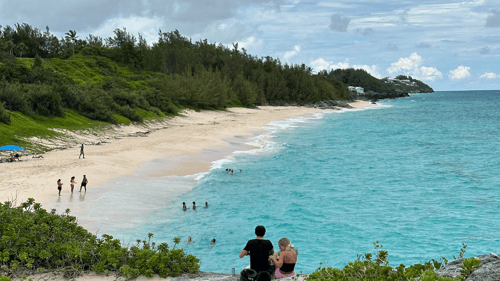

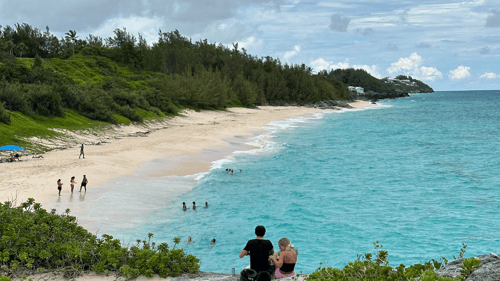

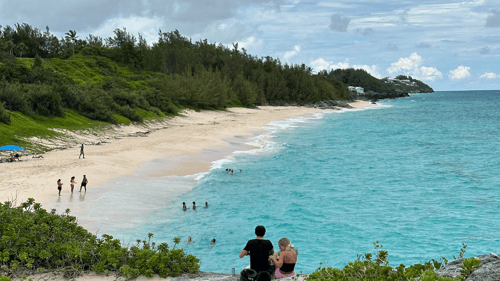

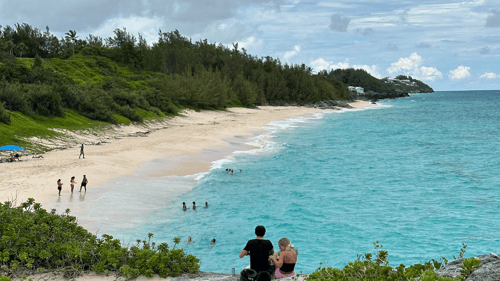

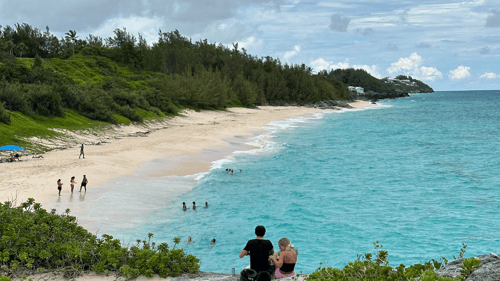

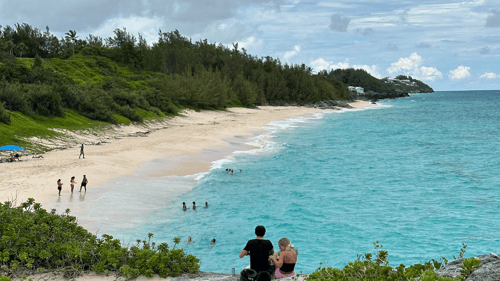

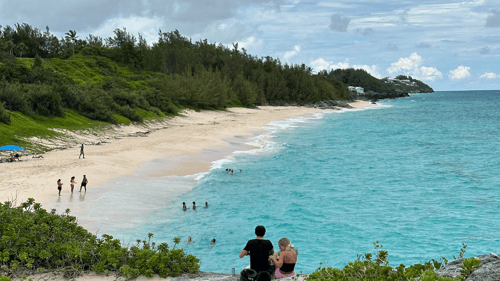

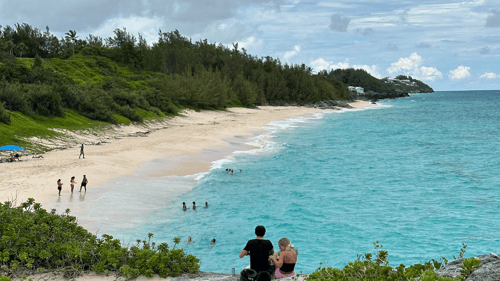

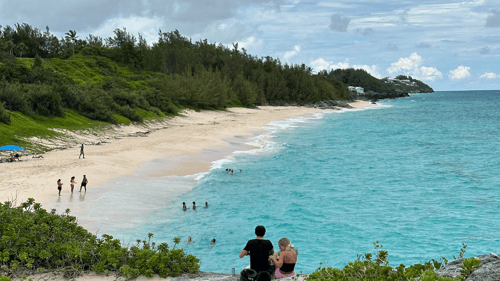

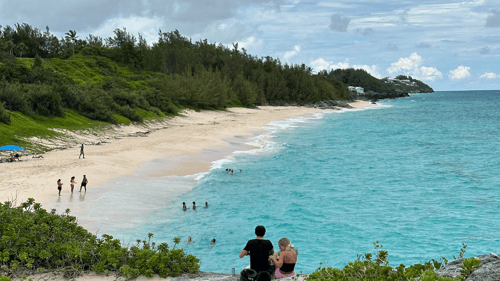

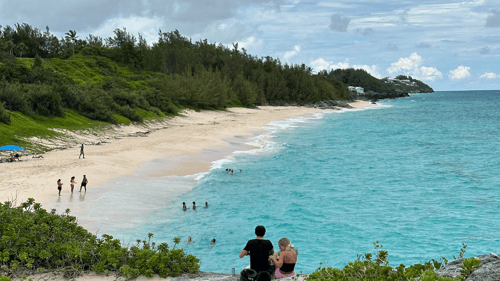

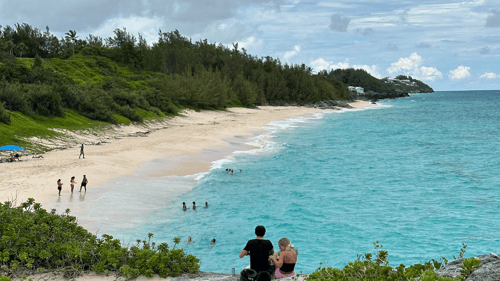

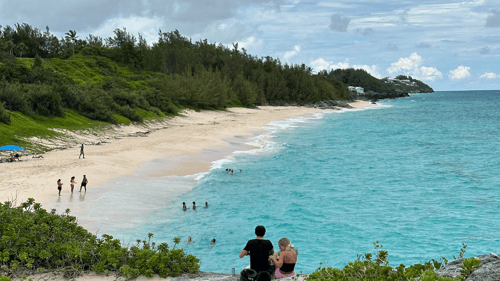

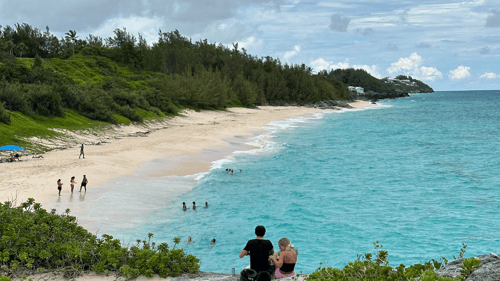

Bermuda Beach Spotlight: Warwick Long Bay

4 minute readWarwick Long Bay, Bermuda, is one of the must-see beaches while you're on the island. The crystal clear waters and...

Read more

Beach Spotlight: Southlands Beach, Bermuda

3 minute readSouthlands Beach, Bermuda, is a beach that offers everything you need for a relaxing experience. This blog post will...

Read more

In the Local Area: Your Guide to Bermuda's Warwick Parish

4 minute readWarwick Parish, Bermuda, is home to stunning beaches, delicious food and friendly faces. If you're visiting the area...

Read more

Is Buying a Condo in Bermuda a Good Business Purchase?

8 minute readLooking for business accommodation can become a costly endeavor. Buying a condo in Bermuda is more than just an...

Read more

Bermuda Beach Spotlight: Jobson's Cove

3 minute readJobson's Cove is a picturesque and serene stretch of coastline on the stunning island of Bermuda. It's situated on the...

Read more

10 Bermuda Historical Sites to Visit

7 minute readGlistening in the pristine waters of the Atlantic Ocean, Bermuda isn’t just a paradise for beach lovers and adventure...

Read more

5 Delicious Restaurants in Warwick, Bermuda

5 minute readBermuda is well-known worldwide for the impeccable assortment of food it offers its visitors — a blend of British,...

Read more

Bermuda Beach Spotlight: Warwick Long Bay

4 minute readWarwick Long Bay, Bermuda, is one of the must-see beaches while you're on the island. The crystal clear waters and...

Read more

Bermuda Beach Spotlight: Jobson's Cove

3 minute readJobson's Cove is a picturesque and serene stretch of coastline on the stunning island of Bermuda. It's situated on the...

Read more

Bermuda Beach Spotlight: Warwick Long Bay

4 minute readWarwick Long Bay, Bermuda, is one of the must-see beaches while you're on the island. The crystal clear waters and...

Read more

Beach Spotlight: Southlands Beach, Bermuda

3 minute readSouthlands Beach, Bermuda, is a beach that offers everything you need for a relaxing experience. This blog post will...

Read more

In the Local Area: Your Guide to Bermuda's Warwick Parish

4 minute readWarwick Parish, Bermuda, is home to stunning beaches, delicious food and friendly faces. If you're visiting the area...

Read more

Bermuda Beach Spotlight: Jobson's Cove

3 minute readJobson's Cove is a picturesque and serene stretch of coastline on the stunning island of Bermuda. It's situated on the...

Read more

10 Bermuda Historical Sites to Visit

7 minute readGlistening in the pristine waters of the Atlantic Ocean, Bermuda isn’t just a paradise for beach lovers and adventure...

Read more

Bermuda Beach Spotlight: Warwick Long Bay

4 minute readWarwick Long Bay, Bermuda, is one of the must-see beaches while you're on the island. The crystal clear waters and...

Read more

Bermuda Beach Spotlight: Jobson's Cove

3 minute readJobson's Cove is a picturesque and serene stretch of coastline on the stunning island of Bermuda. It's situated on the...

Read more

10 Bermuda Historical Sites to Visit

7 minute readGlistening in the pristine waters of the Atlantic Ocean, Bermuda isn’t just a paradise for beach lovers and adventure...

Read more

5 Delicious Restaurants in Warwick, Bermuda

5 minute readBermuda is well-known worldwide for the impeccable assortment of food it offers its visitors — a blend of British,...

Read more

Bermuda Beach Spotlight: Warwick Long Bay

4 minute readWarwick Long Bay, Bermuda, is one of the must-see beaches while you're on the island. The crystal clear waters and...

Read more

Bermuda Beach Spotlight: Jobson's Cove

3 minute readJobson's Cove is a picturesque and serene stretch of coastline on the stunning island of Bermuda. It's situated on the...

Read more

10 Bermuda Historical Sites to Visit

7 minute readGlistening in the pristine waters of the Atlantic Ocean, Bermuda isn’t just a paradise for beach lovers and adventure...

Read more

Bermuda Beach Spotlight: Warwick Long Bay

4 minute readWarwick Long Bay, Bermuda, is one of the must-see beaches while you're on the island. The crystal clear waters and...

Read more

Bermuda Beach Spotlight: Jobson's Cove

3 minute readJobson's Cove is a picturesque and serene stretch of coastline on the stunning island of Bermuda. It's situated on the...

Read more

10 Bermuda Historical Sites to Visit

7 minute readGlistening in the pristine waters of the Atlantic Ocean, Bermuda isn’t just a paradise for beach lovers and adventure...

Read more

5 Delicious Restaurants in Warwick, Bermuda

5 minute readBermuda is well-known worldwide for the impeccable assortment of food it offers its visitors — a blend of British,...

Read more

Bermuda Beach Spotlight: Warwick Long Bay

4 minute readWarwick Long Bay, Bermuda, is one of the must-see beaches while you're on the island. The crystal clear waters and...

Read more

Bermuda Beach Spotlight: Jobson's Cove

3 minute readJobson's Cove is a picturesque and serene stretch of coastline on the stunning island of Bermuda. It's situated on the...

Read more

10 Bermuda Historical Sites to Visit

7 minute readGlistening in the pristine waters of the Atlantic Ocean, Bermuda isn’t just a paradise for beach lovers and adventure...

Read more

5 Delicious Restaurants in Warwick, Bermuda

5 minute readBermuda is well-known worldwide for the impeccable assortment of food it offers its visitors — a blend of British,...

Read more

Bermuda Beach Spotlight: Warwick Long Bay

4 minute readWarwick Long Bay, Bermuda, is one of the must-see beaches while you're on the island. The crystal clear waters and...

Read more

Bermuda Beach Spotlight: Jobson's Cove

3 minute readJobson's Cove is a picturesque and serene stretch of coastline on the stunning island of Bermuda. It's situated on the...

Read more

Bermuda Beach Spotlight: Warwick Long Bay

4 minute readWarwick Long Bay, Bermuda, is one of the must-see beaches while you're on the island. The crystal clear waters and...

Read more

Beach Spotlight: Southlands Beach, Bermuda

3 minute readSouthlands Beach, Bermuda, is a beach that offers everything you need for a relaxing experience. This blog post will...

Read more

In the Local Area: Your Guide to Bermuda's Warwick Parish

4 minute readWarwick Parish, Bermuda, is home to stunning beaches, delicious food and friendly faces. If you're visiting the area...

Read more

Bermuda Beach Spotlight: Jobson's Cove

3 minute readJobson's Cove is a picturesque and serene stretch of coastline on the stunning island of Bermuda. It's situated on the...

Read more

10 Bermuda Historical Sites to Visit

7 minute readGlistening in the pristine waters of the Atlantic Ocean, Bermuda isn’t just a paradise for beach lovers and adventure...

Read more

Bermuda Beach Spotlight: Warwick Long Bay

4 minute readWarwick Long Bay, Bermuda, is one of the must-see beaches while you're on the island. The crystal clear waters and...

Read more

Bermuda Beach Spotlight: Jobson's Cove

3 minute readJobson's Cove is a picturesque and serene stretch of coastline on the stunning island of Bermuda. It's situated on the...

Read more

10 Bermuda Historical Sites to Visit

7 minute readGlistening in the pristine waters of the Atlantic Ocean, Bermuda isn’t just a paradise for beach lovers and adventure...

Read more

5 Delicious Restaurants in Warwick, Bermuda

5 minute readBermuda is well-known worldwide for the impeccable assortment of food it offers its visitors — a blend of British,...

Read more

Bermuda Beach Spotlight: Warwick Long Bay

4 minute readWarwick Long Bay, Bermuda, is one of the must-see beaches while you're on the island. The crystal clear waters and...

Read more

Bermuda Beach Spotlight: Jobson's Cove

3 minute readJobson's Cove is a picturesque and serene stretch of coastline on the stunning island of Bermuda. It's situated on the...

Read more

Bermuda Beach Spotlight: Warwick Long Bay

4 minute readWarwick Long Bay, Bermuda, is one of the must-see beaches while you're on the island. The crystal clear waters and...

Read more

Beach Spotlight: Southlands Beach, Bermuda

3 minute readSouthlands Beach, Bermuda, is a beach that offers everything you need for a relaxing experience. This blog post will...

Read more

In the Local Area: Your Guide to Bermuda's Warwick Parish

4 minute readWarwick Parish, Bermuda, is home to stunning beaches, delicious food and friendly faces. If you're visiting the area...

Read more

Bermuda Beach Spotlight: Jobson's Cove

3 minute readJobson's Cove is a picturesque and serene stretch of coastline on the stunning island of Bermuda. It's situated on the...

Read more

10 Bermuda Historical Sites to Visit

7 minute readGlistening in the pristine waters of the Atlantic Ocean, Bermuda isn’t just a paradise for beach lovers and adventure...

Read more

Bermuda Beach Spotlight: Warwick Long Bay

4 minute readWarwick Long Bay, Bermuda, is one of the must-see beaches while you're on the island. The crystal clear waters and...

Read more

Bermuda Beach Spotlight: Jobson's Cove

3 minute readJobson's Cove is a picturesque and serene stretch of coastline on the stunning island of Bermuda. It's situated on the...

Read more

10 Bermuda Historical Sites to Visit

7 minute readGlistening in the pristine waters of the Atlantic Ocean, Bermuda isn’t just a paradise for beach lovers and adventure...

Read more

5 Delicious Restaurants in Warwick, Bermuda

5 minute readBermuda is well-known worldwide for the impeccable assortment of food it offers its visitors — a blend of British,...

Read more

Bermuda Beach Spotlight: Warwick Long Bay

4 minute readWarwick Long Bay, Bermuda, is one of the must-see beaches while you're on the island. The crystal clear waters and...

Read more

Bermuda Beach Spotlight: Jobson's Cove

3 minute readJobson's Cove is a picturesque and serene stretch of coastline on the stunning island of Bermuda. It's situated on the...

Read more

Bermuda Beach Spotlight: Warwick Long Bay

4 minute readWarwick Long Bay, Bermuda, is one of the must-see beaches while you're on the island. The crystal clear waters and...

Read more

Beach Spotlight: Southlands Beach, Bermuda

3 minute readSouthlands Beach, Bermuda, is a beach that offers everything you need for a relaxing experience. This blog post will...

Read more

In the Local Area: Your Guide to Bermuda's Warwick Parish

4 minute readWarwick Parish, Bermuda, is home to stunning beaches, delicious food and friendly faces. If you're visiting the area...

Read more

Bermuda Beach Spotlight: Jobson's Cove

3 minute readJobson's Cove is a picturesque and serene stretch of coastline on the stunning island of Bermuda. It's situated on the...

Read more

10 Bermuda Historical Sites to Visit

7 minute readGlistening in the pristine waters of the Atlantic Ocean, Bermuda isn’t just a paradise for beach lovers and adventure...

Read more

Bermuda Beach Spotlight: Warwick Long Bay

4 minute readWarwick Long Bay, Bermuda, is one of the must-see beaches while you're on the island. The crystal clear waters and...

Read more

Bermuda Beach Spotlight: Jobson's Cove

3 minute readJobson's Cove is a picturesque and serene stretch of coastline on the stunning island of Bermuda. It's situated on the...

Read more

Bermuda Beach Spotlight: Warwick Long Bay

4 minute readWarwick Long Bay, Bermuda, is one of the must-see beaches while you're on the island. The crystal clear waters and...

Read more

Beach Spotlight: Southlands Beach, Bermuda

3 minute readSouthlands Beach, Bermuda, is a beach that offers everything you need for a relaxing experience. This blog post will...

Read more

In the Local Area: Your Guide to Bermuda's Warwick Parish

4 minute readWarwick Parish, Bermuda, is home to stunning beaches, delicious food and friendly faces. If you're visiting the area...

Read more

Bermuda Beach Spotlight: Jobson's Cove

3 minute readJobson's Cove is a picturesque and serene stretch of coastline on the stunning island of Bermuda. It's situated on the...

Read more

Bermuda Beach Spotlight: Warwick Long Bay

4 minute readWarwick Long Bay, Bermuda, is one of the must-see beaches while you're on the island. The crystal clear waters and...

Read more

Beach Spotlight: Southlands Beach, Bermuda

3 minute readSouthlands Beach, Bermuda, is a beach that offers everything you need for a relaxing experience. This blog post will...

Read more

In the Local Area: Your Guide to Bermuda's Warwick Parish

4 minute readWarwick Parish, Bermuda, is home to stunning beaches, delicious food and friendly faces. If you're visiting the area...

Read more